If you find yourself shocked at how much you’ve spent this month at the end of every month and are always asking yourself how to stop spending money on unnecessary things and how to save more money, this is for you.

It’s incredibly important to start developing healthy financial habits as early as possible. While you may not be thinking about what your life will look like 30 years from now, your financial habits will play a big role. To help you develop better financial habits, we’re sharing our favorite tips to help you save more money and covering:

Let’s get you in financial shape!

Disclaimer: This post contains affiliate links. Purchasing through these links can help me earn money but will not cost you extra.

Automatic Payments and Transfers

Before you start putting extra thought into how you can shape up your budget or earn extra money easily, you need to make sure you’re not necessarily spending on things like late fees.

The number one way to do this is to set up automatic payments so you can never forget to pay your bills. This will not only help you avoid late fees but also ensure you’re not accidentally spending your rent money on late fees.

In addition to automatic payments for essentials that come with a late fee, we recommend setting up automatic transfers into a high-yield savings account or Robo investing account (like Acorns or WealthFront). We recommend putting aside money every month for just general savings and investments. Even a small amount is better than nothing!

If you haven’t started investing because you know nothing about stocks, a Robo investor is the perfect way to start. Based on your risk profile (the level of risk you’re comfortable with), they invest and develop a diverse portfolio for you. Especially if you set up auto transfers, all you have to do is sit back and wait!

Should You Be Budgeting?

Budgeting is for everyone! However, not everyone should budget in the same way. For some, manually tracking through a spreadsheet is effective and satisfying. For someone else, it’s probably entirely too overwhelming and daunting. The key is finding a method that works for you.

How to make a budget

Before you even decide if you’re going to track every dollar you spend by hand, take a spending bucket approach, or sit somewhere in the middle, it’s crucial to figure out what kind of money you have for your different spending categories.

Our free budgeting worksheet auto-calculates how much of your income you should spend on “fun” and how much you should save and invest each month after accounting for your monthly expenses. Once you’ve figured out how much you have to work with, you can choose a method for tracking your spending that works for you. If you’re a manual entry person, a Google sheet can do wonders for you. There are free monthly budget templates you can access through Google Sheets.

A more sophisticated version of this is You Need A Budget (YNAB). This method comes with a cost of $15 a month.

Another more automated option is Mint. You link all of your accounts and cards, and the app helps you create a budget based on your average spending in different categories. This is really the most centralized and automated version if you’re happier with a more hands-off approach.

The 50/20/30 method for budgeting

If you don’t want to track each individual dollar you spend, try the 50/20/30 method. With this method, you divide your income into 50% for essentials (think rent, groceries, gas, insurance, bills), 20% for savings, and 30% for “fun.” If you’re roughly following this, you’ll be able to make sure you cover all of your basics, put aside something for savings each month, and then spend on anything else you want without worrying.

4 Apps to Help You Save Money

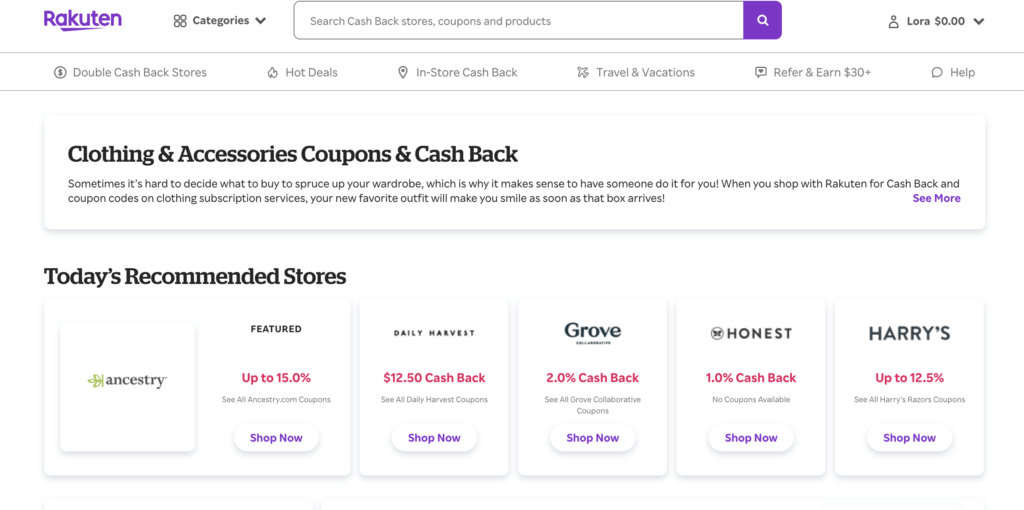

How to save money on groceries: Rakuten

Rakuten is a computer plug-in for online shopping and also has an app. With the app, you can link your credit card and automatically get cashback when shopping in-store at certain places, including Kroger!

However, it can be a hassle to look for deals and cashback. It’s easy to forget when you’re shopping for something. If you can remember to use it or are diligent about checking for deals, it can be super useful.

Even if you’re not a diligent deal scanner, if you shop for groceries at Kroger, it’s still worth setting up for that little bit of cashback.

How to save money when shopping: Honey

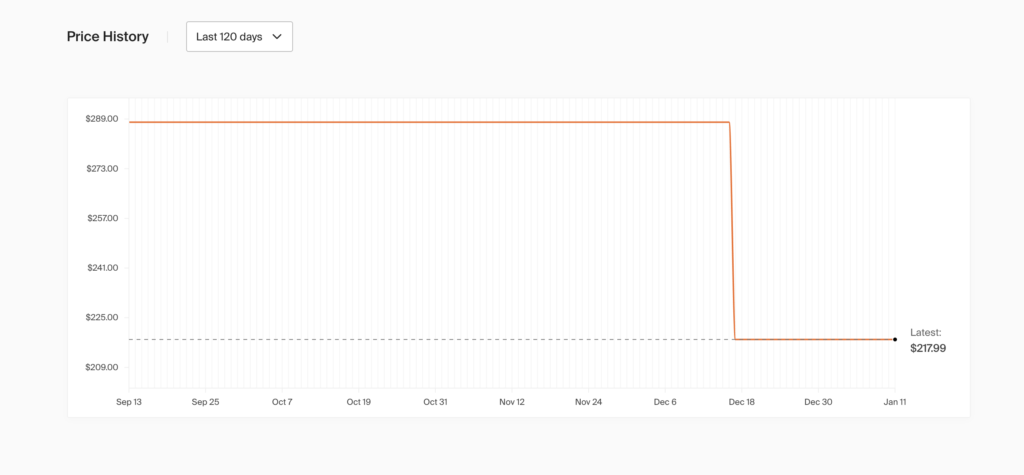

With the Honey browser extension, you can “droplist” items that you want to watch for price drops. Honey works on computers and phones, making it super convenient. You can view past price changes (pictured below) and Honey will notify you if the price drops on that item.

That feature is super helpful for getting the best deal on items, but the best Honey feature is automatic coupon checking. When you enable the Honey extension when you’re checking out, it will automatically test coupons that it has found on the internet to see if they’ll apply to your cart. The worst feeling is buying something only to find out immediately after how much cheaper you could have gotten it.

The last Honey feature is Honey Gold, which is essentially just cashback. When you’re shopping with the extension installed, it will pop up when you’re checking out. From there, you can activate Honey Gold for this purchase – no more work required!

How to save money on Gas: GetUpside

Unless you live in a walkable city (rare in the U.S.), you’re probably already spending money on gas very regularly. Especially with gas prices going up the last few months, your pockets might be feeling a little light! Luckily, there’s an app that actually offers you cashback just for getting gas. They also offer cashback at select grocery stores if you happen to shop there.

Will you become a millionaire with cashback on your gas? Definitely not. But it doesn’t hurt!

How to save money on eating out: Seated

If you love eating out and cannot imagine giving up takeout for the sake of your budget, you need to get Seated.

Unfortunately, Seated doesn’t work in every city. However, if it does work in your city, you can earn up to 35% cashback on your meal. The best rewards are for actually eating at restaurants. But, they also offer smaller cashback rewards on delivery and pickup orders.

The catch is that you can only redeem the rewards for gift cards. But, with gift cards to Uber, Amazon, Target, Sephora, Starbucks, and even Airbnb and hotels.com, it’s still worth it!